Ergo’s ecosystem offers a diverse array of DeFi (Decentralized Finance) opportunities, with lending pools standing out as a particularly accessible way for beginners to start earning passive income. This guide will walk you through what lending pools are, how they operate within the Ergo ecosystem, and how you can leverage them to generate returns on your cryptocurrency holdings.

¶ Understanding Lending Pools

Lending pools are a fundamental component of DeFi, allowing users to lend out their cryptocurrencies in exchange for interest payments. These pools operate on smart contracts, eliminating the need for traditional financial intermediaries like banks. Instead, they create a trustless system where lenders and borrowers interact directly through the blockchain.

¶ How Do Lending Pools Work?

- Lenders Deposit Funds: Users deposit their cryptocurrency into a lending pool. These pools can support a variety of assets, including Ergo (ERG), stablecoins like SigmaUSD, and other tokens available on Ergo.

- Borrowers Take Loans: Borrowers can take out loans from the pool by providing collateral that exceeds the value of the loan, minimizing the risk of default.

- Interest Payments: Borrowers pay interest on their loans, which is then distributed to the lenders as a return on their investment.

- Smart Contracts Manage the Pool: All transactions, including deposits, withdrawals, and interest payments, are governed by smart contracts, ensuring transparency and security.

¶ Best Practices for Lending Pool Participation

- Understand the Terms: Before depositing, make sure you fully understand the pool’s terms, including how interest is calculated, payment frequency, and any applicable fees.

- Diversify: Don’t put all your crypto in one pool. Spread your investments across different assets and platforms to reduce risk.

- Stay Informed: Keep up with developments in the Ergo ecosystem and the broader crypto market. Changes can affect interest rates and lending pool dynamics.

Each pool has their own settings, currently the pools are using a 30% liquidation penalty. So for example, if you borrow $100 of assets and your collateral drops below the 125% ratio (i.e. has a value < $125) then the collateral is liquidated. 100 + (30% * 25) of the collateral is directed to the pool = $107.50, and the borrower receives $17.50 of the liquidated assets.

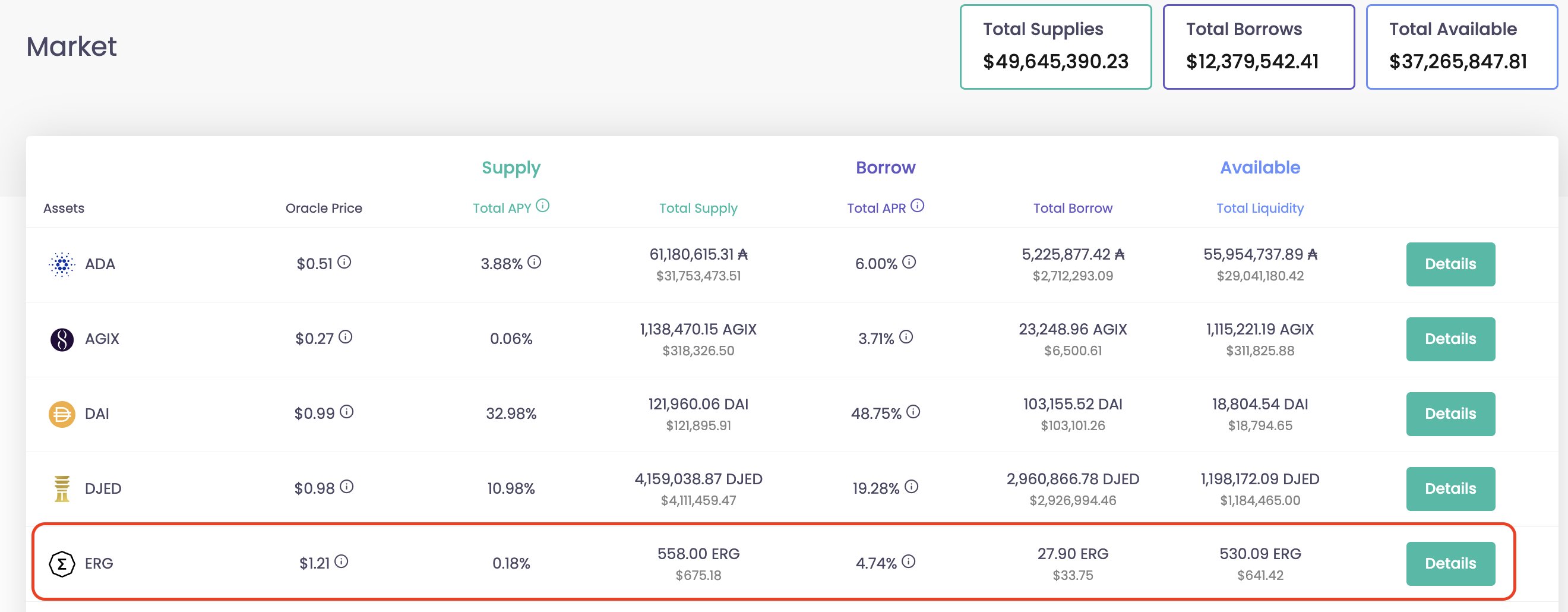

¶ Duckpools: A Prime Example

Duckpools is one of the leading platforms for lending pools within the Ergo ecosystem. It offers a straightforward way for users to earn interest on their ERG and other supported cryptocurrencies. Here’s how to get started:

- Create a Wallet & Acquire ERG: See Getting Started for more details

- Deposit into Duckpools: Follow the instructions on Duckpools to deposit your ERG into one of the lending pools. Ensure you understand the terms, including the interest rate and any fees.

- Earn Interest: Once your ERG is in the pool, you’ll start earning interest. The rate can vary based on demand for loans and the amount of ERG in the pool.

- Some early analytics pulled up by Luivatra shows a 8% return in ~5 months on SigUSD deposited in duckpools.

- Interest Arbitrage Calculator

- Long/Short Calculator

¶ Cross-chain opportunities

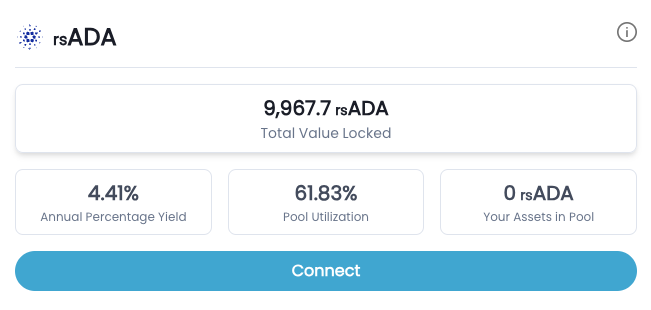

Bridge your $ADA via Rosen Bridge and earn competitive yields

Lend ERG and use it as collateral to borrow $ADA now on app.liqwid.finance

¶ Risks and Considerations

While lending pools on Ergo offer an attractive way to earn passive income, there are risks to be aware of:

- Smart Contract Vulnerabilities: Know Your Assumptions! Though rare, smart contracts can contain vulnerabilities that could be exploited, leading to losses.

- Market Volatility: The value of your deposited cryptocurrency can fluctuate. If the market drops significantly, the real-world value of your interest earnings might be lower than expected.

- Liquidity Risks: In periods of high demand, you might face delays when withdrawing your assets from the pool.

¶ SigmaFi on Ergo: Streamlining Peer-to-Peer Lending

SigmaFi introduces a straightforward approach to lending and borrowing within the Ergo blockchain ecosystem, harnessing the capabilities of decentralized finance (DeFi) to facilitate peer-to-peer (P2P) transactions without traditional intermediaries. This lending protocol leverages the security and flexibility of blockchain technology to offer a practical solution for users needing to access or provide liquidity directly. Here’s a closer look at how SigmaFi operates and the practicalities of using it.

¶ SigmaFi Lending Protocol Explained

At its core, SigmaFi allows any Ergo wallet holder to initiate loan requests or respond to existing ones. The platform’s mechanism is built around the concept of over-collateralization — a necessary feature considering the inherent volatility of cryptocurrencies. For example, securing a loan of 100 SigUSD typically requires collateral in ERG worth 150 SigUSD, offering protection to lenders against market downturns.

The process is streamlined through the creation of smart contracts for each loan, detailing terms and securely holding collateral until the loan is repaid or the term expires. This setup not only ensures the safety of the funds but also the clarity and enforceability of the loan terms.

Join qx() on YouTube as he shows you step by step how to move from Coinbase - Kucoin - Spectrum Finance - Sigmafi!

¶ Practical Uses of SigmaFi

- Emergency Liquidity: Users can quickly borrow against their crypto holdings instead of selling assets, preserving their investment while meeting immediate cash needs.

- Funding Opportunities: SigmaFi facilitates the acquisition of funds for investment in new projects or for personal use, without the complexities of traditional finance.

- Portfolio Diversification: Borrowers can diversify their investment strategies by leveraging SigmaFi loans to explore new market opportunities.

¶ Engaging with SigmaFi: How to Start

The SigmaFi Quick Start Guide provides concise steps for wallet setup, loan creation, and fulfillment, facilitating a swift initiation into the platform.

- Explore SigmaFi: Visit SigmaFi to review available loans and their terms.

- Connect Your Wallet: Use an Ergo-compatible wallet to interact with the SigmaFi platform.

- Lending or Borrowing: Choose whether to offer liquidity as a lender or to request funds as a borrower based on the outlined terms.

- Loan Management: Borrowers should keep track of their obligations, while lenders monitor their investments directly through the platform.

¶ The SigmaFi Ecosystem

SigmaFi’s reliance on the extended unspent transaction output (eUTXO) model provides a secure foundation for its operations. The platform’s open-source contracts invite further innovation, allowing developers to build upon or integrate these mechanisms into new or existing DeFi applications, enriching the Ergo DeFi landscape.

SigmaFi offers a functional solution for P2P lending within the Ergo blockchain, simplifying the process for both borrowers and lenders. Its approach to over-collateralization, combined with the security of smart contracts, makes it a practical tool for users looking to engage in direct financial transactions.

Stay updated and join the community on Telegram for more information and support.

¶ EXLE

EXLE represents a groundbreaking shift in the lending industry, utilizing blockchain technology to establish a global, peer-to-peer lending platform. Governed by a decentralized autonomous organization (DAO), it aims to democratize lending by providing universal access, irrespective of business size, geographic location, or the prevailing interest rates determined by major financial institutions. This initiative directly addresses the challenges in the current financial system, which often fails to offer small loans at fair rates, especially impacting the unbanked and those in rural areas. By eliminating intermediaries, EXLE lowers borrowing costs, making smaller loans feasible and opening up a vast, previously inaccessible market of borrowers.

The platform emphasizes secure, trustless transactions and privacy, allowing individuals to effectively “be their own bank.” This innovation not only benefits borrowers by offering more accessible loan options but also reduces operational and underwriting costs, leveraging widespread cell phone access to bring financial services to users’ fingertips.

EXLE’s token sale is facilitated by Ergopad, with the token distribution structured to support various stakeholders, including Ergopad stakers, the core team, and a reserve for the DAO, among others. Starting as ‘Ergo-Lend’ during the ErgoHack 2 hackathon, EXLE’s journey reflects a committed effort to address the financial barriers faced by billions of unbanked individuals worldwide through key stages of implementation outlined in its roadmap.

¶ Conclusion

Lending pools on Ergo represent a compelling opportunity for earning passive income through DeFi. By carefully selecting platforms like Duckpools, understanding the associated risks, and adhering to best practices, beginners can successfully navigate the world of crypto lending. As always, remember to conduct your own research and consider your financial situation and risk tolerance before participating in any DeFi activities.