¶ Yielding Success: How to Farm and Provide Liquidity on Ergo

In the dynamic world of decentralized finance (DeFi), yield farming and liquidity provision stand as cornerstone strategies for cryptocurrency enthusiasts looking to maximize their digital asset returns. Ergo, with its innovative DeFi ecosystem, offers unique opportunities for users to engage in these activities. This guide will delve into how to successfully farm yields and provide liquidity within the Ergo ecosystem, ensuring both beginners and seasoned DeFi participants can navigate these processes with confidence.

¶ Understanding Yield Farming and Liquidity Provision

Yield Farming involves staking or lending your cryptocurrency assets in a DeFi protocol to earn interest or rewards. This strategy leverages the power of smart contracts to automate earning opportunities in various DeFi projects.

Liquidity Provision, on the other hand, requires users to deposit their assets into a liquidity pool. These pools fuel marketplace activities, enabling trading and lending on decentralized exchanges (DEXs) and lending platforms. In return for contributing to these pools, providers earn transaction fees generated from the trades or loans facilitated by their liquidity.

Join qx() as he takes you through a one shot no edits no nonsense take on how to swap, provide LP, and farm on Spectrum in Spectrum - Swap, LP, Farm | One Take Series

¶ Spectrum Finance

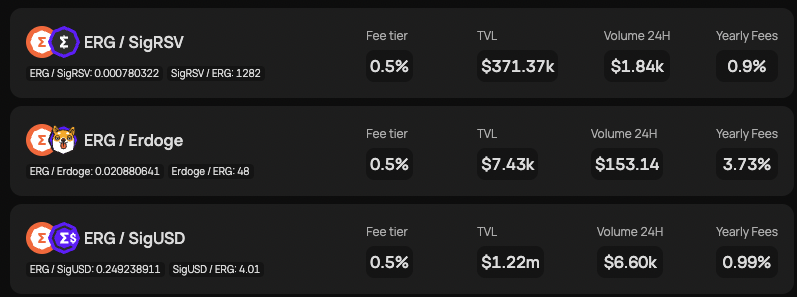

Spectrum Finance is a decentralized exchange (DEX) on Ergo that offers both yield farming and liquidity provision opportunities.

There are several pools on Spectrum with a visible estimated asset annual percentage yield (APY) that can be used for yield harvesting.

Your redeemable amount changes as the pool gets used and a percentage of the swaps are earned by the pool. You get a percent of the pool fee proportional to your stake.

Here’s how to get started:

- Create a Wallet: First, ensure you have an Ergo wallet set up.

- Acquire ERG: You’ll need ERG, the native token of the Ergo platform, to participate in yield farming and liquidity provision. ERG can be purchased on various centralized and decentralized exchanges.

- Deposit Assets into Spectrum: Navigate to the Spectrum Finance platform and connect your wallet. Look for liquidity pools that match your investment strategy and deposit your assets. These can include ERG paired with other tokens.

- Start Farming or Providing Liquidity: Once your assets are deposited, you’ll automatically start earning rewards based on the trading fees or through specific yield farming programs hosted on Spectrum.

¶ Best Practices for Yield Farming and Liquidity Provision on Ergo

- Risk Management: Understand the risks involved, including impermanent loss in liquidity pools and the volatility of the crypto market.

- Research: Stay informed about the latest Ergo DeFi projects and yield farming opportunities. Joining the Ergo community on forums and social media can provide valuable insights.

- Diversify: Spread your investments across different pools and farming opportunities to mitigate risk.

- Monitor Performance: Regularly check the performance of your investments. Be prepared to adjust your strategy in response to changing market conditions or new opportunities.

¶ Leveraging SigmaUSD and SigmaRSV for Yield on Ergo

SigmaUSD, along with SigmaRSV, offers varied strategies for yield farming within the Ergo ecosystem. These options range from direct minting to engaging in secondary market trades, each presenting unique opportunities and considerations.

-

Minting SigmaUSD: You can create SigmaUSD through a process of collateralization on the Ergo blockchain. While direct minting is typically done via platforms like SigmaUSD and TokenJay, or through the Minotaur wallet, it’s important to note that SigmaUSD’s site isn’t ‘official’ but rather one of the various user-friendly interfaces for the protocol.

-

Secondary Market Dynamics: SigmaUSD can also be acquired from secondary markets like the Spectrum liquidity pool. Here, the price of SigmaUSD may vary from its ideal peg, primarily due to supply and demand dynamics. For instance, if SigmaUSD’s demand exceeds its supply in the pool, its price might slightly increase above $1, and vice versa.

-

Arbitrage Opportunities: These price variations in the secondary market can lead to arbitrage opportunities. Savvy traders might buy SigmaUSD at a lower price from the secondary market and redeem it for $1 worth of collateral or sell it at a higher price when the demand spikes, earning a profit from these price discrepancies.

¶ Pairing Strategies for Yield Farming

-

SigmaRSV/ERG Pair: Pairing SigmaRSV with ERG can be an effective way to minimize impermanent loss due to their correlated price movements. This strategy is particularly appealing for those who wish to benefit from ERG’s potential upside while mitigating risk.

-

SigmaUSD/ERG Pair: Engaging in a SigmaUSD/ERG pair might entail a higher risk of impermanent loss, given SigmaUSD’s stable nature against ERG’s fluctuating price. However, this pairing can be profitable for earning transaction fees, especially when there is significant trading volume and liquidity in the pool.

These strategies offer a spectrum of risk and reward scenarios in the Ergo ecosystem, catering to different investor profiles. From stable, pegged assets to more volatile pairings, SigmaUSD and SigmaRSV provide versatile tools for yield farming and potential arbitrage, making them an integral part of a diversified crypto portfolio.

¶ Leveraging CEX Tools and Programs

-

Trading Bots: Automate your arbitrage strategies using grid bots available on KuCoin and Huobi. These bots can buy low and sell high within predefined price ranges, perfect for capturing short-term price movements.

-

AMM Pools: Participate in automated market maker pools available on CoinEx and nonkyc to earn transaction fees while waiting for arbitrage opportunities. These pools can offer passive income and serve as a hedge against market volatility.

-

Gate.io Lending Utilize lending services to earn interest on your holdings.

¶ Centralized Exchange Offerings

In the context of our project, which was launched with fairness at its core, there isn’t a single entity or individual that holds a significant portion of the total supply. This means that we don’t have the option to rely on a single market-maker to ensure liquidity in the market. However, this doesn’t pose a barrier to achieving a truly liquid market. In fact, it opens up the opportunity for a more decentralized and robust liquidity provision. By encouraging a large number of participants to contribute smaller amounts, we can collectively create a market that is not only liquid but also more resilient and less susceptible to manipulation. This approach aligns with our commitment to decentralization and community participation.

| Opportunity | Type | Platform / Project | Status | Description |

|---|---|---|---|---|

| KuCoin Grid Bots | Trading Bot | KuCoin | Live | Grid trading bot for buying and selling |

| CoinEx AMM Pool | Exchange, LP | CoinEx | Live | Liquidity providing in AMM pool |

| Gate.io Lending | Exchange, Lending | Gate.io | Live | Lending assets for interest |

| Huobi Trading Bots | Trading Bot | Huobi | Live | Various trading bots for automation |

| Custom Bots | Trading Bot | shrimpy.io, 3commas | Live | Custom trading bot solutions |

| Low-Liquidity Exchanges | Long-term Offer | SevenSeas, TradeOgre, etc | Live | Profit off exchanges with low liquidity by acting as a Market Maker (See Arbitrage) |

¶ Run your own grid bots

There are several tools that let you run grid bots within and outwith Ergo, see This section in the Off Chain Article for more information.

¶ Conclusion

Yield farming and liquidity provision on Ergo offer exciting avenues for earning passive income in the DeFi space. By leveraging platforms like Spectrum Finance and engaging with innovative mechanisms like SigmaUSD, users can participate in the growth of Ergo’s DeFi ecosystem. Remember, success in yield farming and liquidity provision requires a combination of diligent research, strategic planning, and ongoing engagement with the community. Happy farming!

¶ Resources

- ERGODEX GAINS CALCULATOR FOR LIQUIDITY PROVIDERS

- sigmaUSD_V5

- LP Pool Calculation spreadsheet.

- Liquidity Provision: Yield Opportunities and Experiences

¶ Automated Market Makers (AMMs)

An Automated Market Maker (AMM) uses mathematical models to set the price and match buyers and sellers rather than merely matching buy and sell orders, as in traditional order-books. AMM is best in markets with low liquidity.

One of the features of AMM is that liquidity providers add assets to the exchange for a fee, and the market benefits from an increase in liquidity, smaller latency, limited price slippage, and less market volatility when using this additional liquidity.

Please be aware of impermanent loss.

¶ Impermanent Loss / Volitality Harvesting

Impermanent loss (IL) occurs when the mathematical formula of an AMM adjusts the asset ratio in a pool to ensure both assets remain at an even value.

Example: You enter an AMM pool of Erg/SigUSD, when the prices of each of these assets is at $10 and $1. So, you put in 1 Erg for every $10 SigUSD into the pool.

Then, Erg’s price goes to $20 a month later. Let’s assume you earned $2 in fees. You’ll then have 0.8 Erg and $16 SigUSD to have even amounts in the pool, or $32. The higher the price of Erg relative to SigUSD, the less Erg you have.

So, why would anyone provide liquidity to an AMM in an asset they expected to go up and a stablecoin like SigUSD? The answer: volitality harvesting.

There’s an involved paper, but here’s the central idea: digital assets like Erg don’t just increase. They have a lot of volitality, ups and downs, and if you are in an AMM liquidity pool, the balancing of the AMM of the pool works as a kind of dollar cost averaging. It buys more of the asset that costs less when it is down and less of the asset that costs more when it is up.